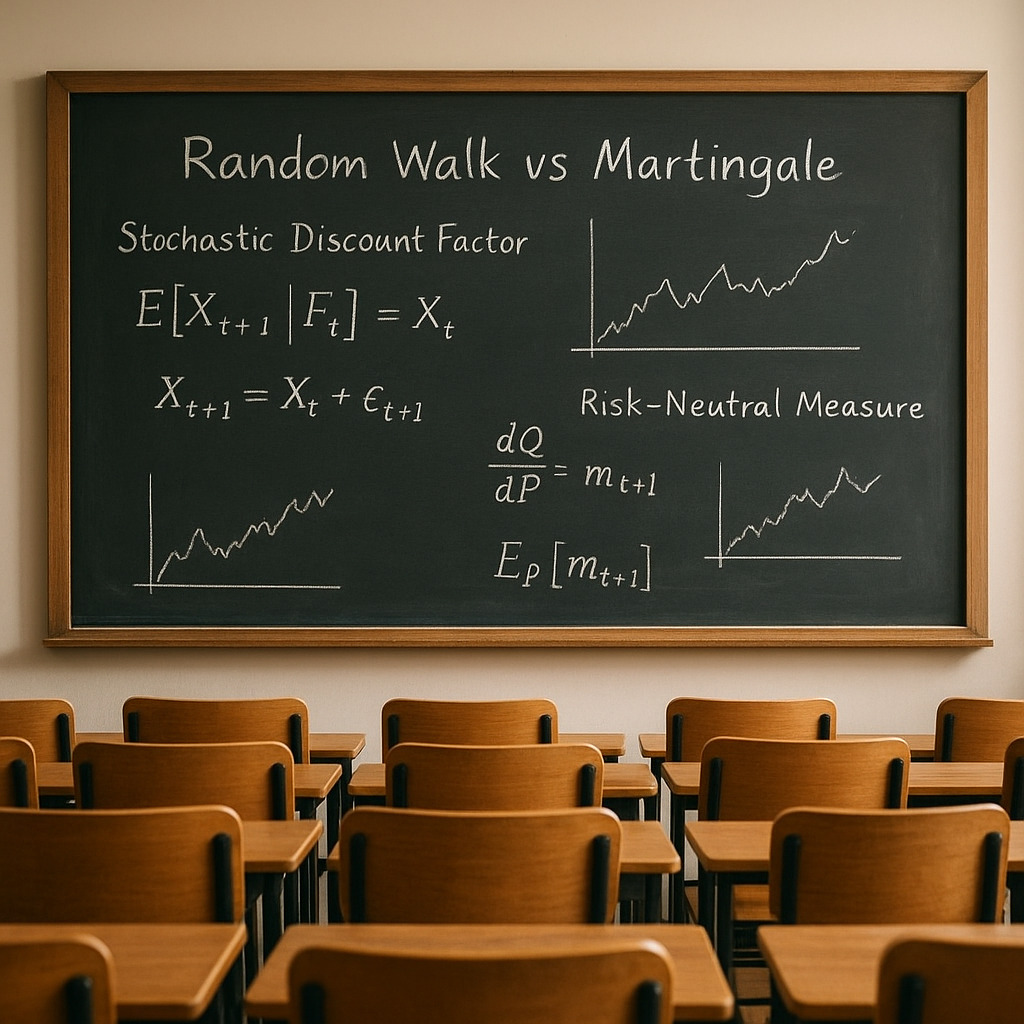

From Drift to Martingale: Risk-Neutral Measure Explained

November 12, 2025

Learn how the risk-neutral measure mathematically transforms a random walk with drift into a martingale by removing its drift, with clear step-by-step explanations.

Read More